News/Blogs

AMCP 2024: Essential Takeaways from This Year’s Annual Meeting

May 9, 2024 (LinkedIn) — In this article, we discuss our teams’ top takeaways, provided by Clinical Account Executive Aimee Solo, PharmD, from this year’s Academy of Managed Care Pharmacy (AMCP) meeting. The article highlights therapeutic areas with the highest spending growth, including antidiabetics, dermatology, oncology, vaccines, and obesity, while spending percentages have decreased for Mental Health and Multiple Sclerosis. Biosimilars have achieved over $23.6B in savings since 2015, but their uptake is slow, disincentivizing manufacturers to continue entering the marketplace. GLP-1s and weight loss were a focus at the conference and may exceed specialty spend in the next year. Drug shortages are expected to continue as manufacturers fail inspections, and the number of COVID and flu vaccines administered at retail locations has decreased compared to the previous years.

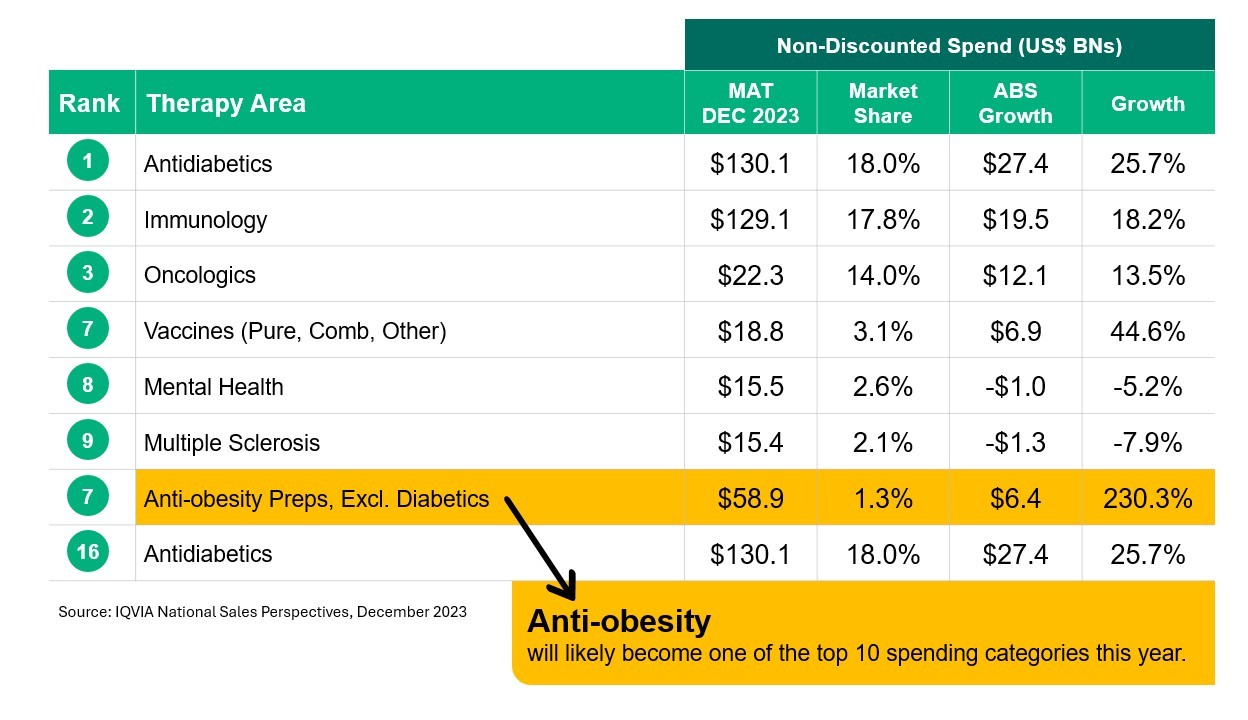

Top Therapeutic Areas

Therapeutic areas with the highest spending growth include antidiabetics, dermatology, oncology, vaccines, and obesity. Conversely, spending percentages have decreased for Mental Health and Multiple Sclerosis.

Anti-obesity will likely become one of the top 10 spending categories this year.

Biosimilar Savings and Patient Access

According to data from the IQVIA Biosimilars Council, biosimilars have achieved over $23.6B in savings since 2015. These savings are expected to increase as more biosimilars with interchangeability status become available. Interchangeability allows for easier substitution at the pharmacy level and less administrative burden on providers.

Competition among biosimilars and their reference products is reducing prices in the biosimilar market.

The Biosimilar Pipeline

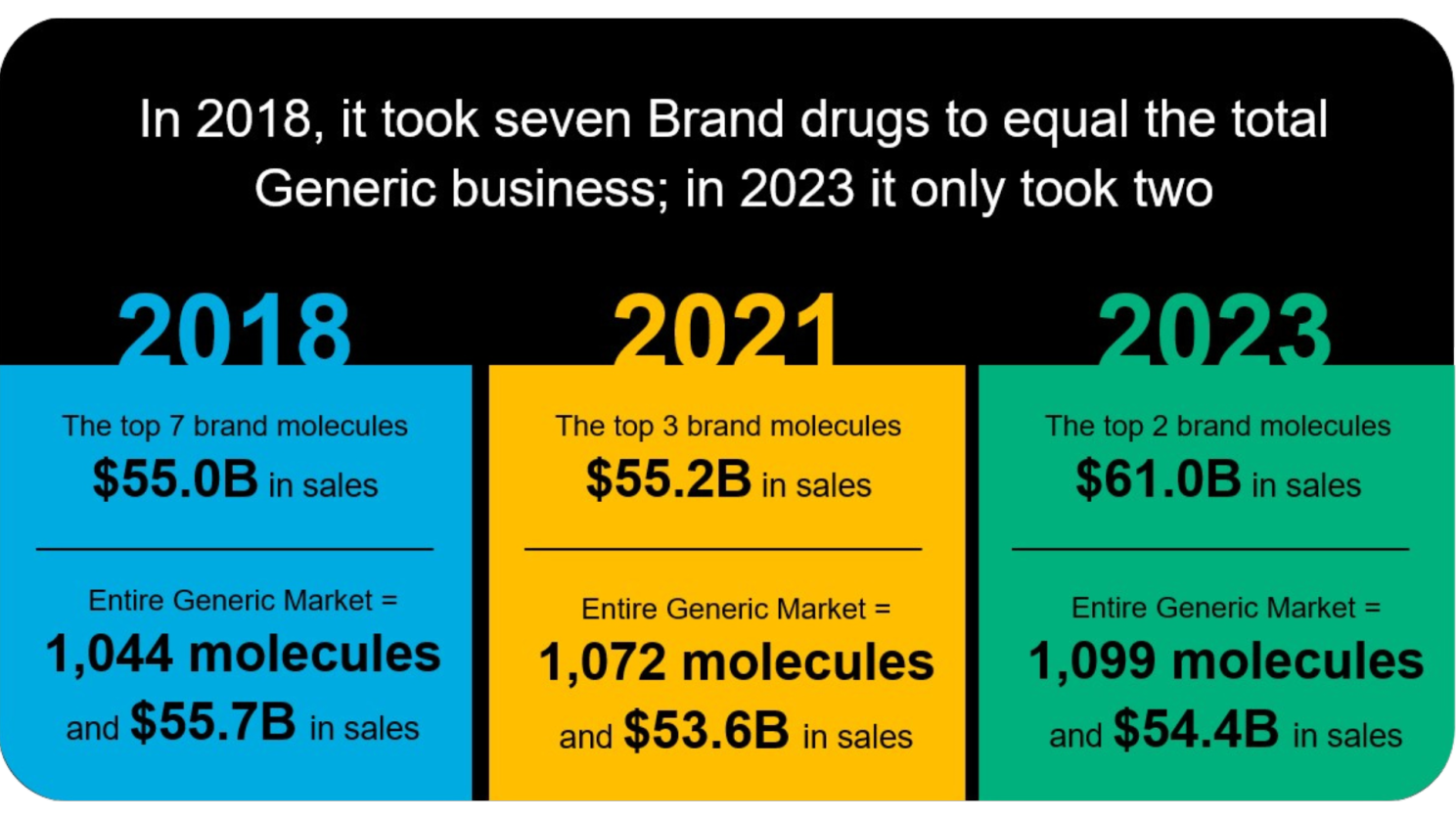

In 2023, we witnessed the introduction of nine Humira Biosimilars. Humira, topping the charts as the #1 Brand molecule in sales for the year, dominated the market. Analyzing the pipeline, it appears unlikely that we’ll witness another substantial wave of manufacturers launching similar blockbuster biosimilars soon.

According to a report from IQVIA, biosimilar sales are rising, but the uptake is slow. The slow uptake is disincentivizing manufacturers to continue entering the marketplace. With fewer manufacturers making new biosimilars, prices will stay higher. Significant numbers of biologics currently do not have a pipeline. Although the number of biologics is high, they tend to be lower-value molecules and should not be overlooked.

A Focus on GLP-1s

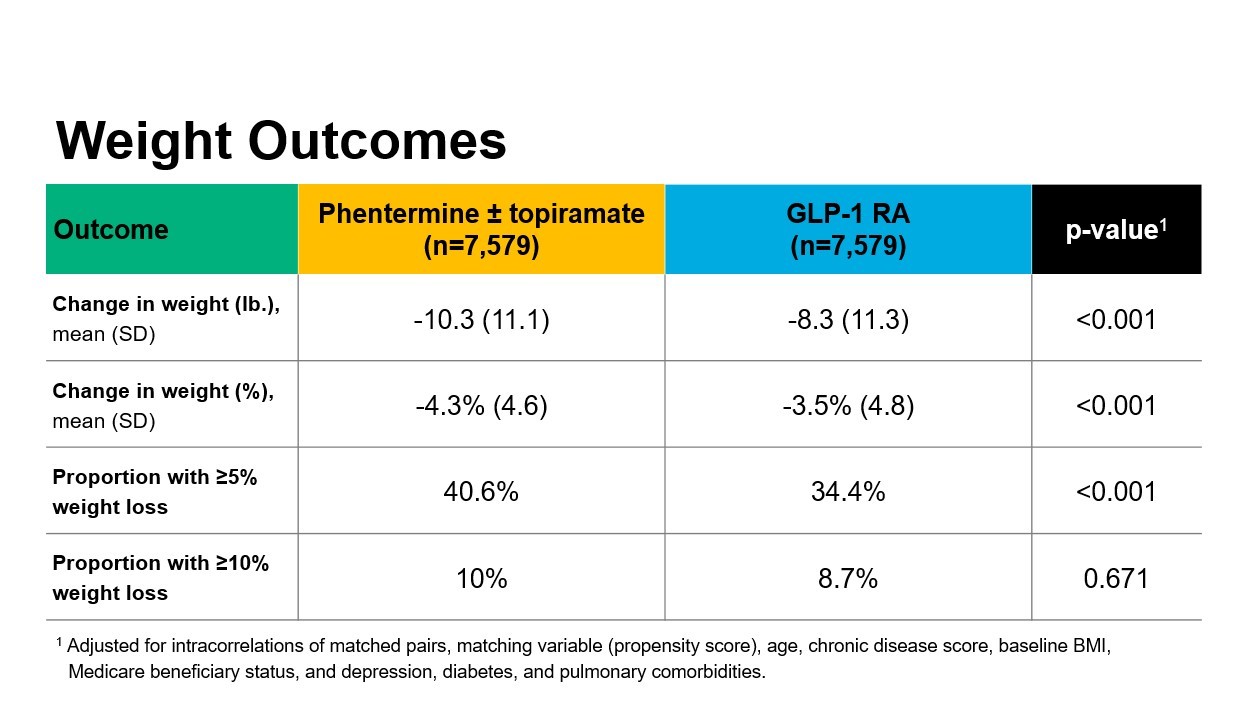

GLP-1s and weight loss were a focus at the conference. Surveys suggest that 30-40% of employer-sponsored health plans currently include GLP-1s for weight management. With GLP-1s such as semaglutide gaining approval for broader use in conditions related to obesity, like cardiovascular disease, it’s worth noting that Real World Evidence doesn’t universally support their superiority.

A Real-World Evidence trial from a major US health system found that lower-cost options like phentermine with or without topiramate yielded better results than semaglutide. GLP-1s must be prescribed only after lifestyle changes have been attempted for six months. Case management is important to prevent early discontinuation due to side effects.

With the launch of Humira biosimilars in 2023, GLP-1s may exceed specialty spend in the next year.

Specialty Spend Remains Consistent

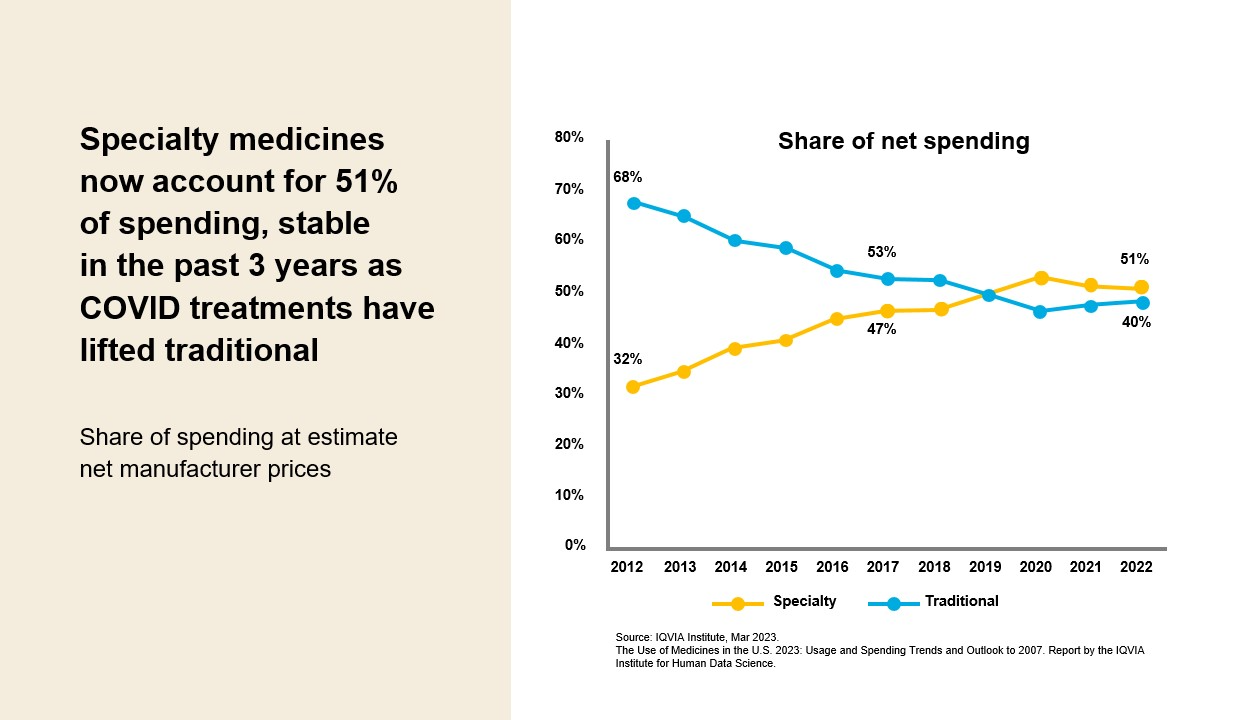

Of note, while spending in categories like anti-obesity medications has increased, specialty medication spending has remained stable at 51% for the last three years.

Drug Shortages

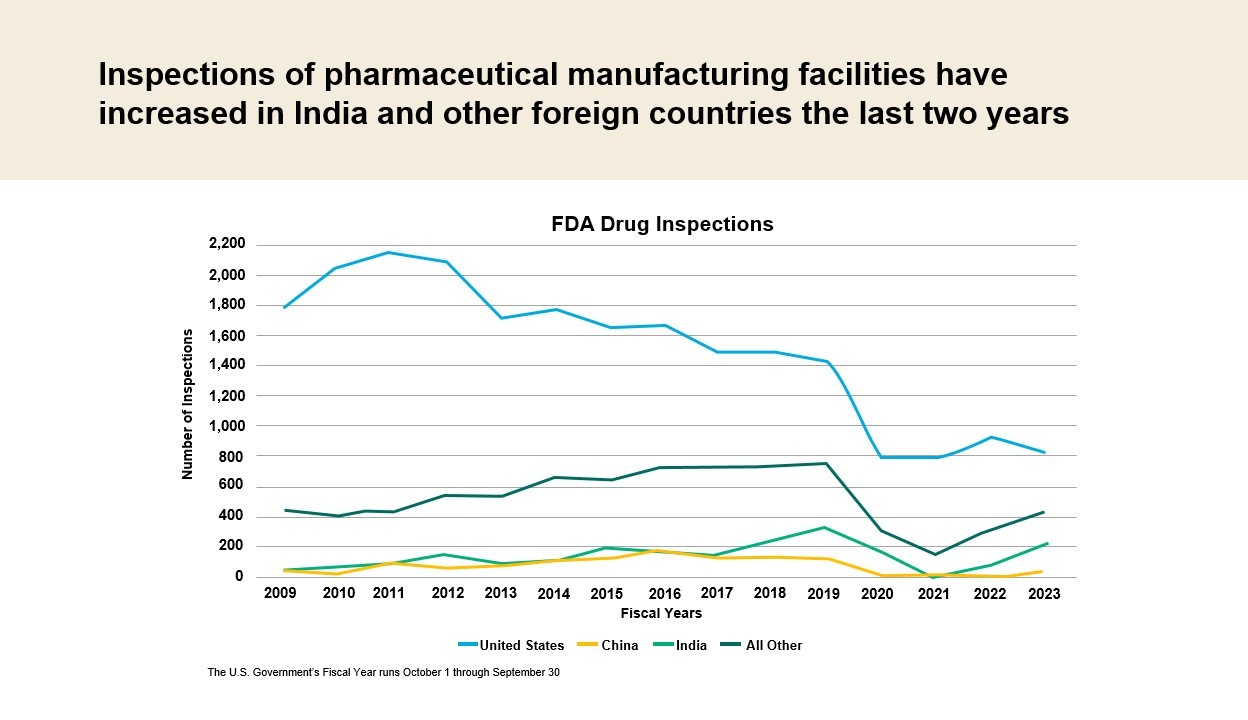

Drug shortages are expected to continue as manufacturers fail inspections. Although manufacturer inspections are increasing, they are still below pre-pandemic levels.

Some shortages have been created by demand, including Cisplatin, carboplatin, amoxicillin, Ozempic, Mounjaro, Trulicity, and Adderall.

Manufacturing in India failed inspections, leading to shortages of Cisplatin and carboplatin, which in turn led to shortages in hospitals. Additionally, Akorn Pharmaceuticals went out of business, and there are frequent drug shortages in important generics in the Asthma and ADHD categories.

Vaccine Administration

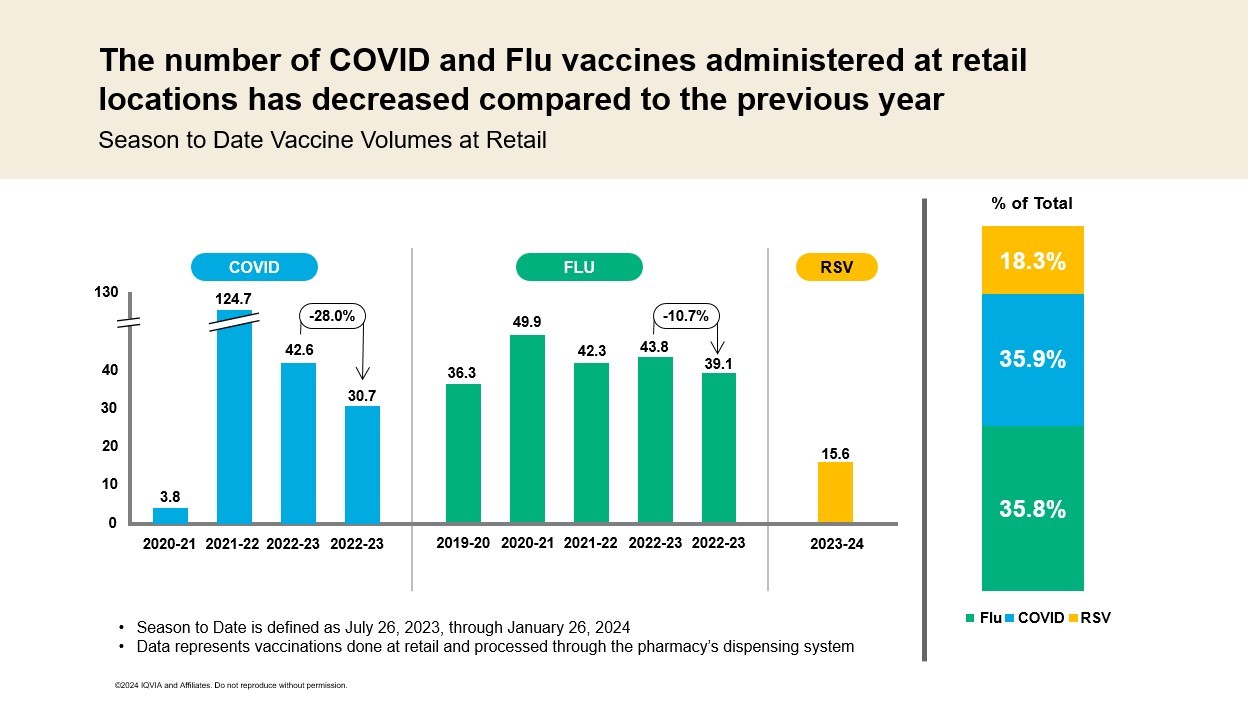

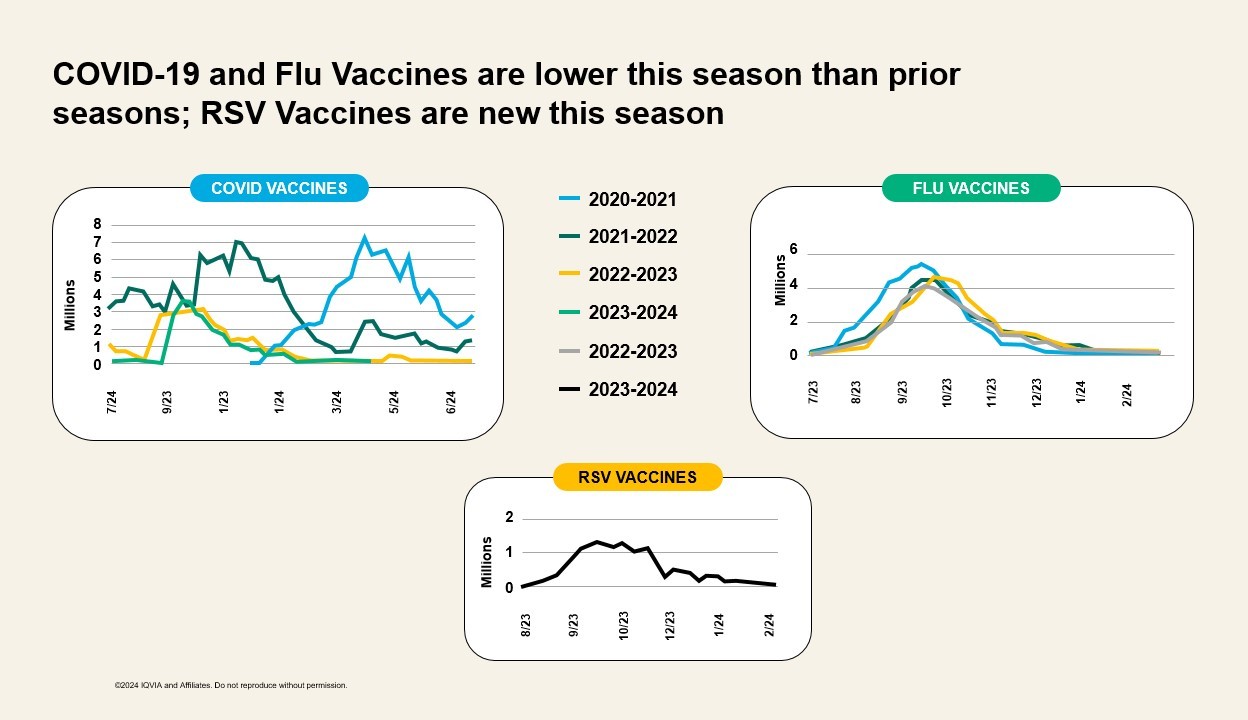

The number of COVID and flu vaccines administered at retail locations has decreased compared to the previous years. While COVID and flu vaccines decreased, RSV vaccines has had its first season. We will have to wait until next season to see the trend for this vaccine.

About Serve You Rx®

Serve You Rx is a full-service pharmacy benefit manager (PBM) with unquestionable flexibility and an unwavering commitment to doing what’s best for its clients. With a fervent focus on those it serves, including insurance brokers, consultants, third-party administrators, and their clients, Serve You Rx delivers exceptional service and tailored, cost-effective benefit solutions. Independent and privately held for nearly 40 years, Serve You Rx can implement new groups in 30 days or less and say “yes” to a wide variety of viable solutions. Known for its adaptability, quality, and client-centricity, Serve You Rx aims to be a benchmark for better client service.