News/Blogs

GLP-1s Increasing Plan Drug Spend – What’s Next?

Background

GLP-1 agonists continue to strain plan sponsor budgets due to soaring utilization rates. Despite prior authorization protocols, managing this class of medications is becoming increasingly challenging. The market is witnessing the emergence of more effective GLP-1s, with several new ones slated for release in 2026-2027, leading to an inevitable escalation of costs.

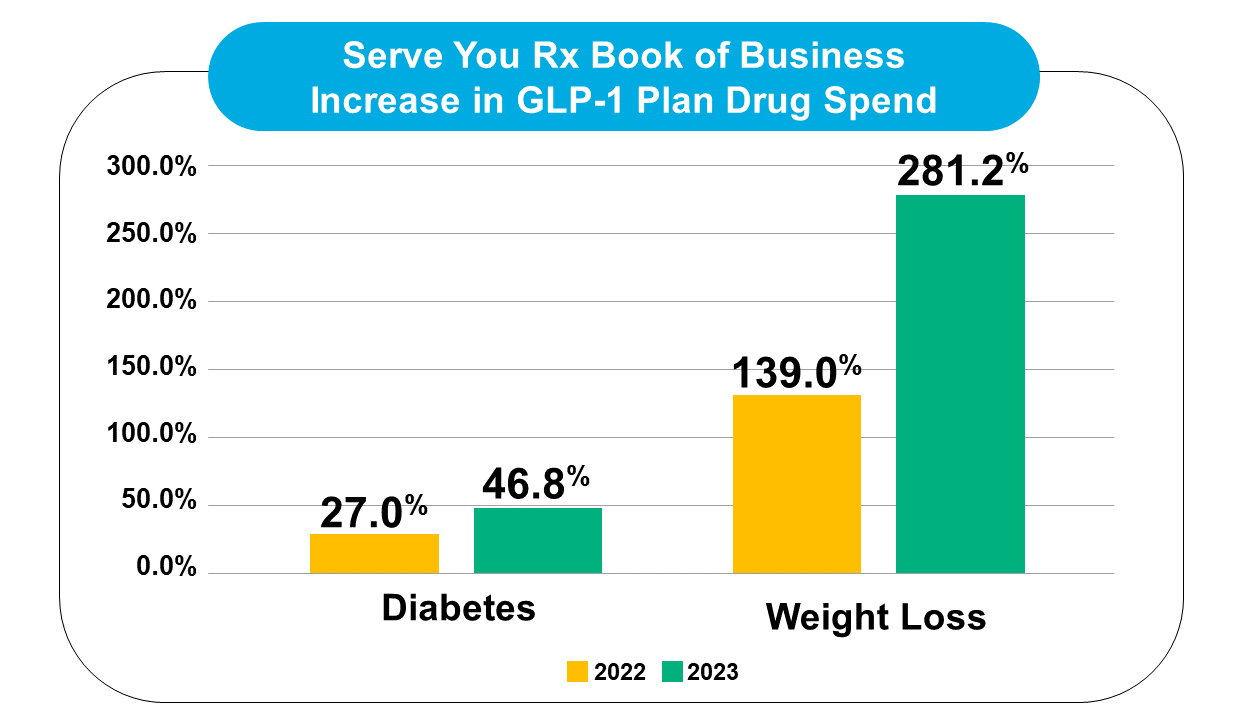

We have noticed a similar upward trend in utilization and spend for GLP-1s across our book of business, with plan drug spend for Wegovy alone increasing over 500% between 2022 and 2023.

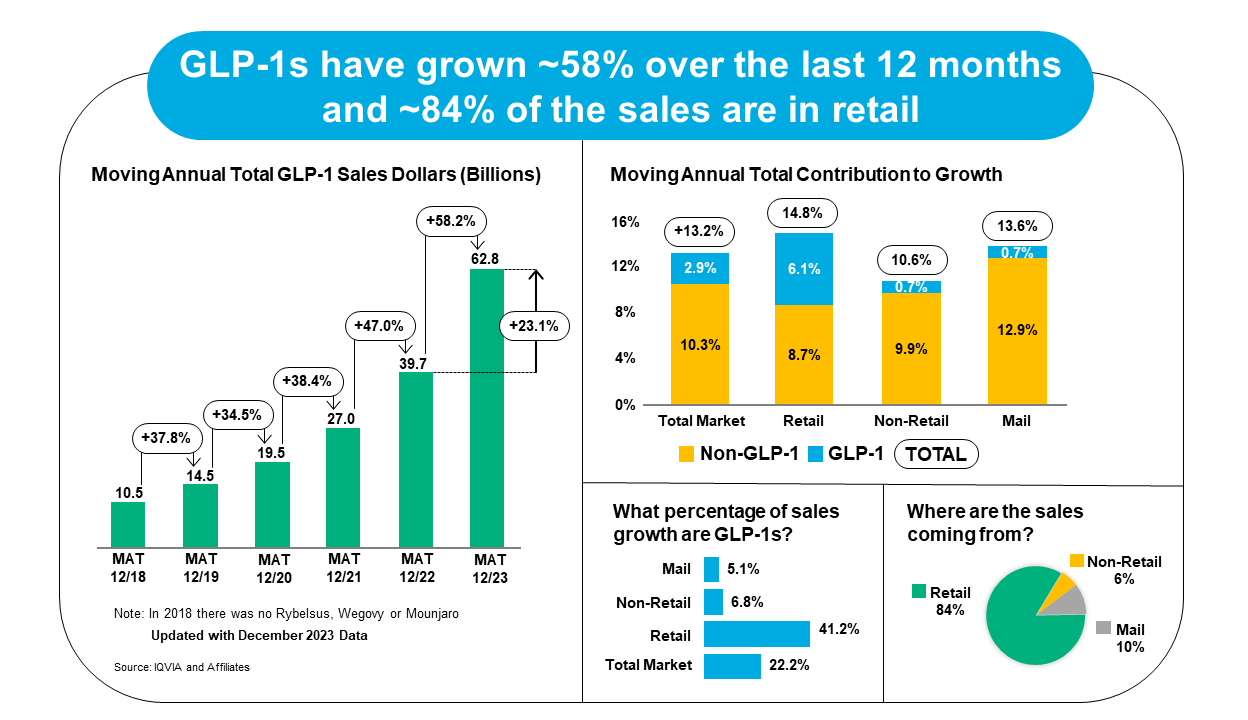

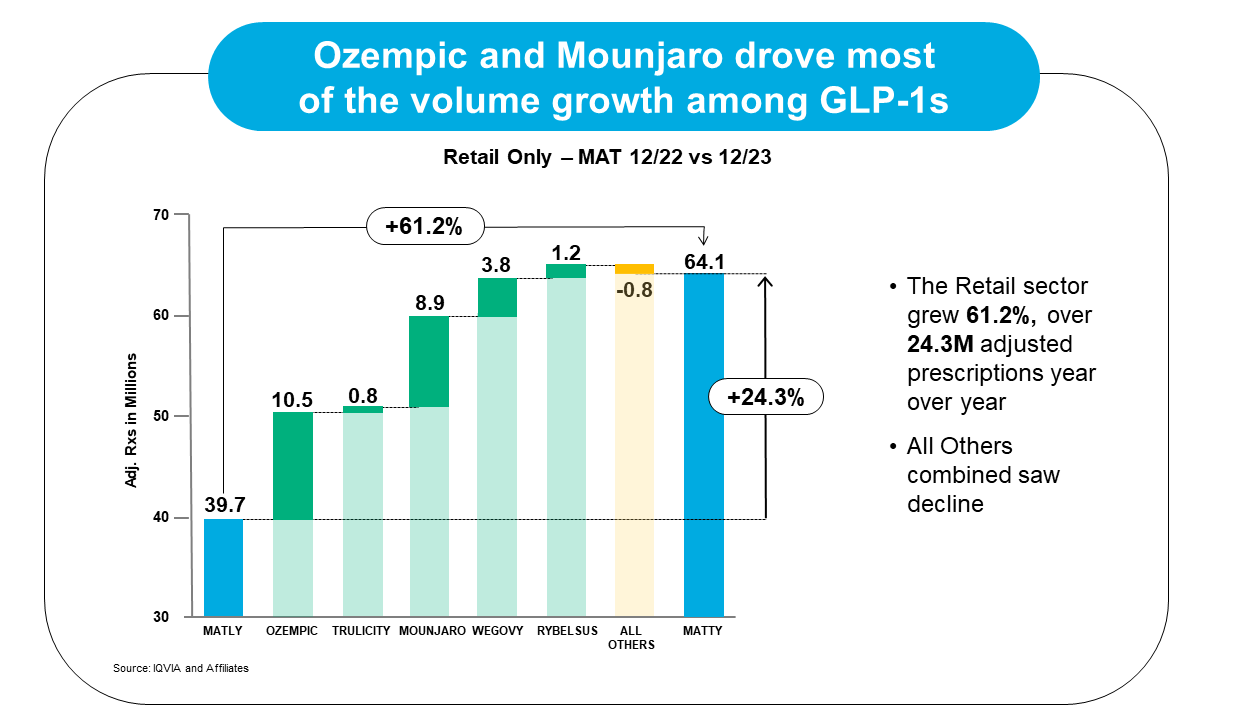

GLP-1 agonist drug sales increased 58.2% between December 2022 and December 2023, with Ozempic and Mounjaro driving most of that growth volume.

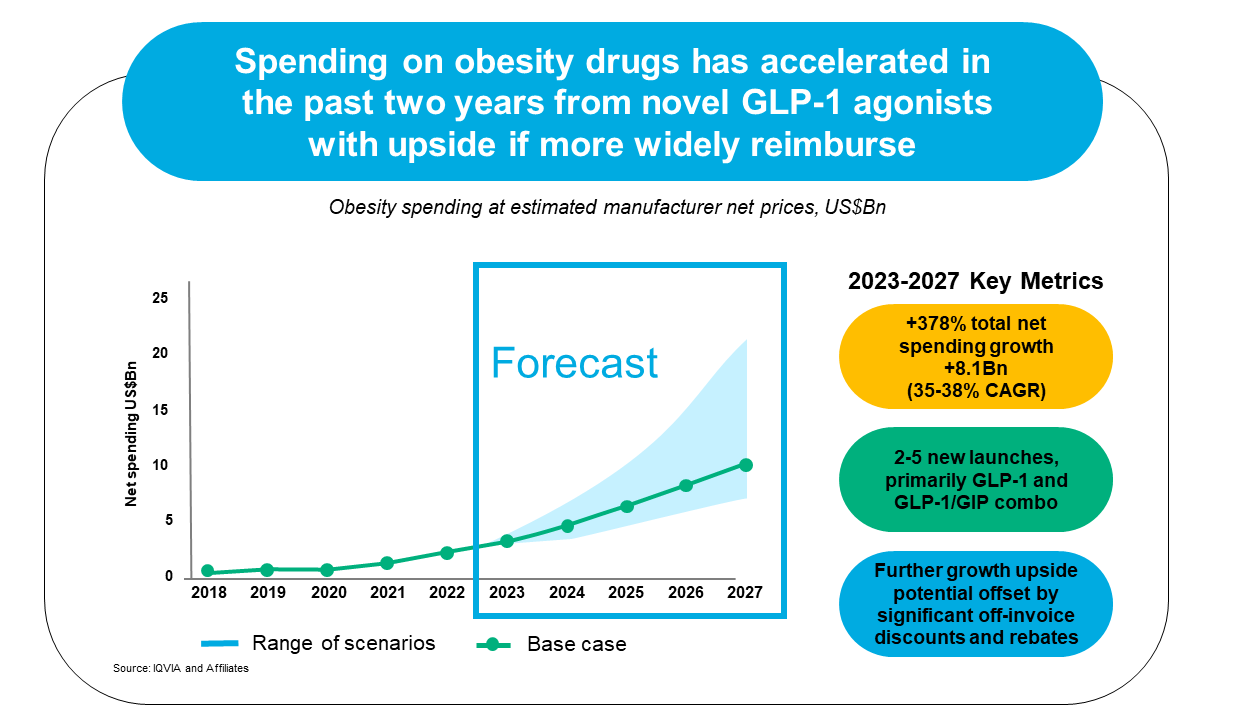

Total net spending on obesity drugs is forecasted to increase 378% between 2023 and 2027 and includes the launch of 2-5 novel GLP-1 and GLP-1/GIP combination drugs.

Report by the IQVIA Institute for Human Data Science

GLP-1 Pipeline

In November 2023, the FDA approved Zepbound (tirzepatide), a GLP-1 antagonist and GIP dual agonist with superior weight loss efficacy compared to its competitors. The GLP-1 class continues to expand, with even more effective medications expected. The table below provides a glimpse into the evolving landscape of the GLP-1 class.

| Drug Name | Indication | Mechanism of Action | Manufacturer | Route and Administration | Clinical Trial Status |

|---|---|---|---|---|---|

| Cagrilintide; semaglutide (CagriSema) | Type 2 Diabetes; Obesity | GLP-1/amylin analog agonist | Novo Nordisk | Subcutaneous once weekly | Phase III |

| Oral semaglutide | Obesity | GLP-1 agonist | Novo Nordisk | Oral once daily | Phase III |

| Retatutide | Type 2 Diabetes; Obesity | GLP-1/GIP/Glucagon receptor agonist | Eli Lilly | Subcutaneous once weekly | Phase III |

| Orforglipron | Type 2 Diabetes; Obesity | GLP-1 agonist | Eli Lilly | Oral once daily | Phase III |

| Survodutide | Type 2 Diabetes; Obesity | GLP-1/Glucagon agonist | Boehringer Ingelheim | Subcutaneous once weekly | Phase II |

| Danuglipron | Type 2 Diabetes; Obesity | GLP-1 agonist | Pfizer | Oral twice daily | Phase II |

| Pemvidutide | Obesity | GLP-1/Glucagon receptor agonist | Altimmune | Subcutaneous once weekly | Phase II |

| AMG 133 (MariTide) | Obesity | GLP-1 agonist; GIP antagonist | Amgen | Subcutaneous once monthly | Phase II |

To remain competitive, cost estimates for these new drug approvals are expected to be between $10,000 and $18,000 annually at wholesale acquisition cost. Victoza (liraglutide), the first GLP-1 for type 2 diabetes to lose exclusivity in June 2024, may not generate significant savings due to its once-daily dosing and limited market share. The next GLP-1 indicated for type 2 diabetes to lose exclusivity is Trulicity (dulaglutide) in 2027.

Our GLP-1 Solutions

We take a comprehensive approach to ensuring the appropriate use of GLP-1 antagonists. including a prior authorization protocol that requires chart documentation of a type 2 diabetes diagnosis based on a recent A1C (measurement of average blood sugar levels) equal to or greater than 6.5%.

This workflow ensures that members who need these medications can access them while maintaining appropriate utilization control. Moreover, we offer flexibility in designing weight loss drug coverage to meet the specific needs of our plan sponsors. We tailor our solutions to their unique requirements. For example, plans may elect to cover brand and generic weight loss medications, generics only, or exclude these products from the pharmacy benefit altogether.

Other Innovative Solutions

To further support our clients and their members, we created our Diabetes Care Plus program. This comprehensive program aims to improve member health education and outcomes while maximizing plan savings. By providing targeted support and resources, we empower members to manage their diabetes and overall health better.

Looking ahead, we are excited to announce the upcoming launch of our Cardiometabolic Program in Q3 2024. This innovative program will integrate GLP-1 medication management with cognitive behavioral therapy and nutritional guidance, taking a holistic approach to improving member health outcomes.

Author: Clinical Account Executive Marc Zande, PharmD

About Serve You Rx

Serve You Rx is a full-service pharmacy benefit manager (PBM) with unquestionable flexibility and an unwavering commitment to doing what’s best for its clients. With a fervent focus on those it serves, including insurance brokers, consultants, third-party administrators, and their clients, Serve You Rx delivers exceptional service and tailored, cost-effective benefit solutions. Independent and privately held for over 37 years, Serve You Rx can implement new groups in 30 days or less and say “yes” to a wide variety of viable solutions. Known for its adaptability, quality, and client-centricity, Serve You Rx aims to be a benchmark for better client service.

Give your clients the transparency and insights they want.

Fill out the form below, and discover the Serve You Rx difference.